Hello world!

December 10, 2020How To Control Addiction Through Effective Meditation Strategies

February 28, 2022

This vital adjustment reflects the accrual accounting’s core principle of accurately recording transactions, maintaining the integrity of the closing entries process. It keeps the financial statements coherent, showing exactly how much of the profits are plowed back into closing entries the company, and how much is given back to investors. It’s a delicate balance that corporations must manage – supporting growth and rewarding investment, all shown transparently thanks to closing entries.

Permanent Accounts

- Adhering to this order – adjusting then closing – ensures your financial narratives don’t become tangled and that every period’s reporting is as crisp as a freshly printed playbill.

- Income Summary is a temporary closing account used to store the closing balance of revenue and expenses.

- Likewise, if a temporary account has a credit balance, it is debited to bring it to zero and the retained earnings account is credited.

- If you put the revenues and expenses directly into retained earnings, you will not see that check figure.

- He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

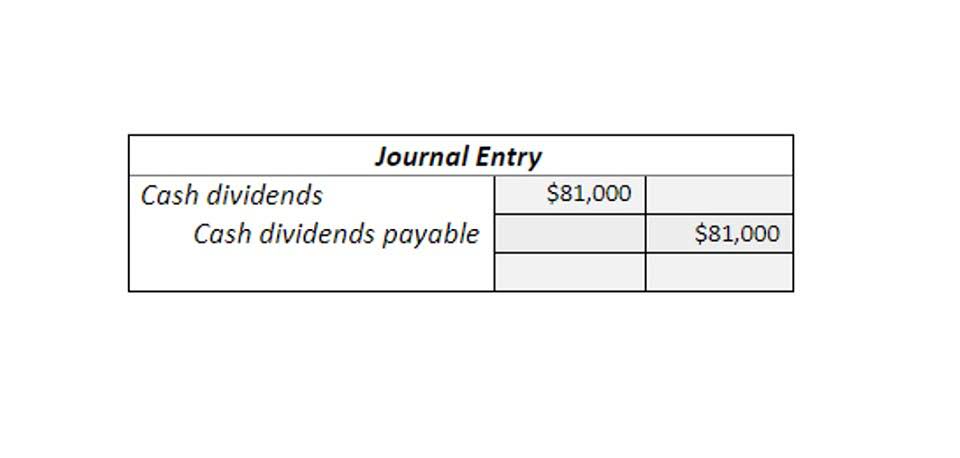

- If this is the case, then this temporary dividends account needs to be closed at the end of the period to the capital account, Retained Earnings.

Temporary accounts are income statement accounts that are used to track accounting activity during an accounting period. For example, the revenues account records the amount of revenues earned during an accounting period—not during the life of the company. From this trial balance, as we learned in the prior section, you make your financial statements. After the financial statements are finalized and you are 100 percent sure that all the adjustments are posted and everything is in balance, you create and post the closing entries. The closing entries are the last journal entries that get posted to the ledger.

Closing Entries’ Role Across Accounting Periods

After the closing journal entry, the balance on the drawings account is zero, and the capital account has been reduced by 1,300. If you skip or rush through closing entries, you risk misstatements in both the petty cash income statement and balance sheet. As an experienced accountant, I’ve seen firsthand how crucial closing entries are for maintaining accurate financial records. The income summary is a temporary account used to make closing entries.

Unit 4: Completion of the Accounting Cycle

With just a few clicks, Enerpize accurately transfers balances from revenue and expense accounts to the income summary and updates retained earnings or capital. This not only saves time but also ensures accuracy and consistency in your financial records, helping you close your books confidently. Closing entries are essential for preparing financial statements for the next accounting period.

All the temporary accounts, including revenue, expense, and dividends, have now been reset to zero. The balances from these temporary accounts have been transferred to the permanent account, retained earnings. Once all the adjusting entries are made the temporary accounts reflect the correct entries for revenue, expenses, and dividends for the accounting Budgeting for Nonprofits year. We can also see that the debit equals credit; hence, it adheres to the accounting principle of double-entry accounting. Conversely, if faced with a net loss, the Income Summary would be credited and the Owner’s Capital account debited, reflecting the decrease in equity. It’s a classic example of accounting symmetry, tying the ebbs and flows of your financial activities directly to your business’ worth.

What is the correct order for closing accounts?

- This increases the retained earnings by the amount of net income, thereby completing the closing process.

- It is essential to settle outstanding accounts receivable and payable before the transfer to clear any existing liabilities.

- Think of closing entries as a way to reset your accounting books at the end of a period, whether that’s monthly, quarterly, or annually.

- This requires creating journal entries that debit the income summary account and credit each expense account.

- The information needed to prepare closing entries comes from the adjusted trial balance.

- Alright, now that we’ve got a clear understanding of closing entries, why we need them, and how they keep our financials clean, we’re ready to move on to actually closing those revenue accounts.

Since 2014, she has helped over one million students succeed in their accounting classes. To better understand how closing entries work in practice, let’s follow a complete example for SmartTech Solutions, a small consulting firm, at the end of their fiscal year on December 31, 2024. We have completed the first two columns and now we have the final column which represents the closing (or archive) process. This is where mistakes tend to creep in—whether it’s a missed entry or a miscalculated balance, small errors can lead to significant reporting issues. The better you handle them, the more reliable your financial statements will be, and that means fewer surprises down the line. Closing entries aren’t just a formality—they are a necessary step for keeping your books clean and accurate.

- Before distributing cash, a business must finalize all cash account adjustments.

- While manual closing entries are foundational to understanding accounting principles, most modern businesses use software to streamline this process.

- The total debits should equal the total credits, reflecting the total expenses incurred during the period.

- The trial balance is like a snapshot of your business’s financial health at a specific moment.

- The closing entries are the last journal entries that get posted to the ledger.

Notice that the balance of the Income Summary account is actually the net income for the period. Then, just pick the specific date and year you want the closing process to take place, and you’re done! In just a few clicks, the entire financial year closing is streamlined for you.

Which closing entries are necessary at the final month-end before a business ceases operations?

After preparing the closing entries above, Service Revenue will now be zero. After this closing entry has been posted, each of these revenue accounts has a zero balance, whereas the Income Summary has a credit balance of $7,400. If the period incurred a loss, the Retained Earnings account must nobly absorb the impact, ensuring that the loss is reflected in the equity of the company. Once this important shift is accomplished, your ledger is primed and polished for the upcoming period, and you start anew, applying one of the vital takeaways—closing entries steps performed consistently. If dividends were not declared, closing entries would cease at this point. If dividends are declared, to get a zero balance in the Dividends account, the entry will show a credit to Dividends and a debit to Retained Earnings.